SC rejects review pleas against verdict allowing states to tax mineral rights - Indian Express; The Hindu

Context

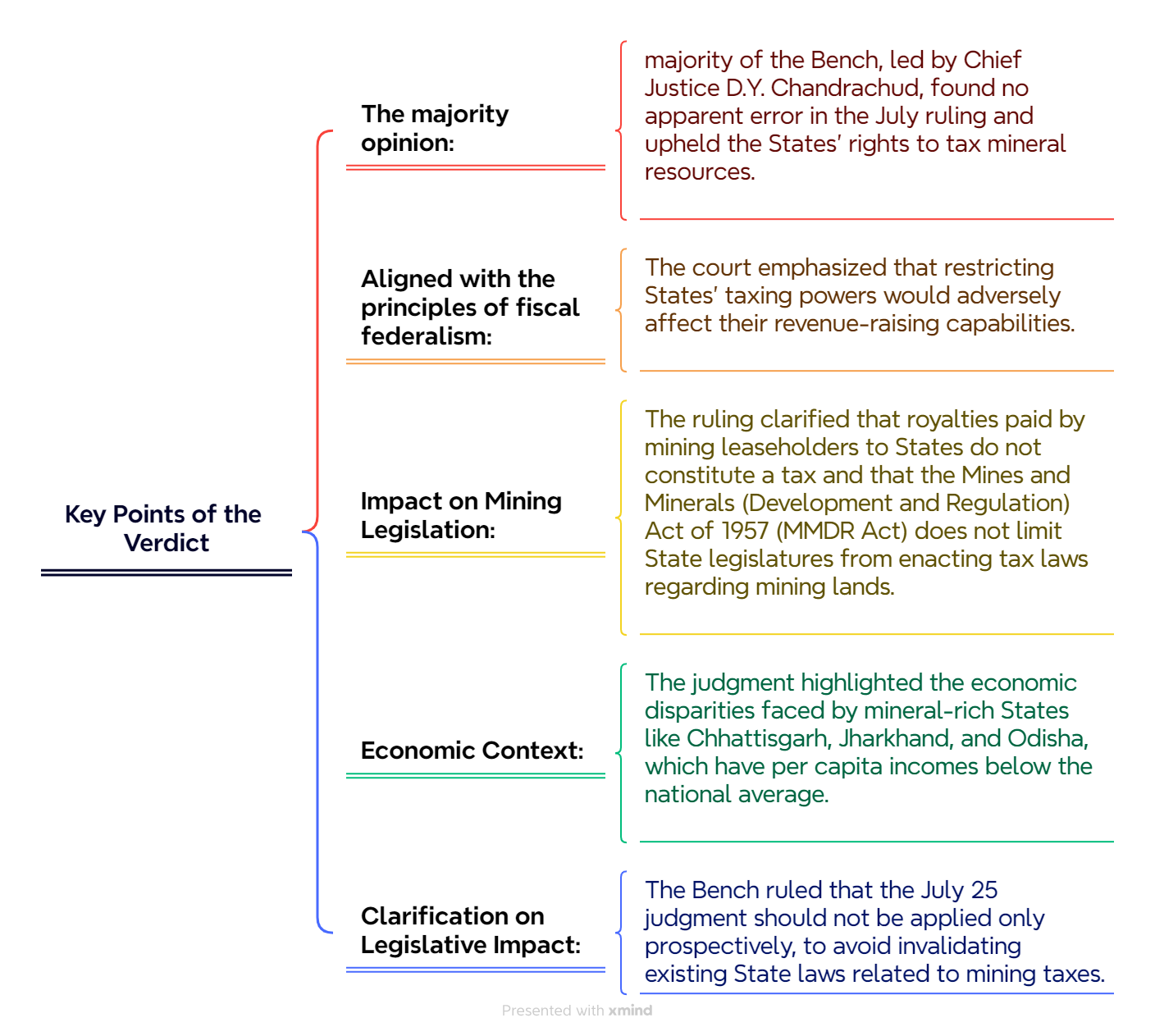

The Supreme Court of India has dismissed review petitions challenging its July 25 judgment, which upheld the power of State legislatures to tax mineral-bearing lands and quarries. This ruling reinforced the federalist principles of governance, asserting the autonomy of States in managing their mineral resources and tax policies.

Background of the Case

- In its July 25 decision, the Supreme Court ruled that states have the legislative authority to tax mineral rights and that royalties paid on minerals do not constitute a tax.

- This verdict provided the states the legal framework to continue collecting royalties on mineral extractions, a major source of revenue for several state governments.

Implications

- This ruling upholds the financial autonomy of states over mineral resources, ensuring a steady revenue stream.

- However, the judgment may impact the mining industry, as States may adjust their tax policies to optimize revenue from mineral resources.

- The Centre's concerns about the broader economic impact remain unaddressed with the dismissal of the reviews.